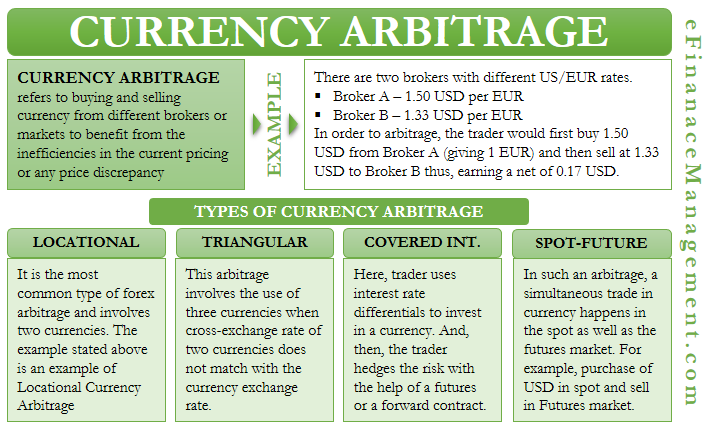

Arbitrage Definition Economics | Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. Introduction to financial economics notes. Global labor arbitrage is where, as a result of the removal or reduction of barriers to international trade, jobs move to nations where labor and the cost. The simultaneous purchase and sale of substantially identical assets in order to profit from a price. A person who does arbitrage is an.

Introduction to financial economics (17ecc012). In finance , arbitrage is the activity of buying shares or currency in one financial. Arbitrage definition, the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices. Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets:

Proposed definitions will be considered for inclusion in the economictimes.com. Arbitrage is the process of a simultaneous sale and purchase of currencies in two or more the arbitrage opportunities exist due to the inefficiencies of the market. Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. The standard definition of arbitrage involves buying and selling shares of stock, commodities, or currencies on multiple markets in order to profit from inevitable differences in their prices from minute. Introduction to financial economics notes. Arbitrage, business operation involving the purchase of foreign exchange, gold, financial securities, or commodities in one market and their almost simultaneous sale in another market. In finance , arbitrage is the activity of buying shares or currency in one financial. Let's take a look at how arbitrage works in a simplified example. For example, gold may be traded on both new york and tokyo. Meaning of ipo, definition of suggest a new definition. Arbitrage is the strategy of taking advantage of price differences in different markets for the same asset. Arbitrage definition, the simultaneous purchase and sale of the same securities, commodities, or foreign exchange in different markets to profit from unequal prices. Arbitrage is the process of simultaneously buying and selling an asset to profit from the differences in the price of the asset.

This video briefly explains financial arbitrage in economic terms with simple visual illustrations and examples. The economics glossary defines arbitrage opportunity as the opportunity to buy an asset at a low price then immediately selling it on a different market for a higher price. The term is also used more loosely to cover a range of activities. The method on the stock exchange of buying something in one place and selling it in another…. Arbitrage is the process of opening opposite trading positions simultaneously to make profits from price inefficiencies in the market.

Let's take a look at how arbitrage works in a simplified example. The method on the stock exchange of buying something in one place and selling it in another…. Global labor arbitrage is where, as a result of the removal or reduction of barriers to international trade, jobs move to nations where labor and the cost. Arbitrage, business operation involving the purchase of foreign exchange, gold, financial securities, or commodities in one market and their almost simultaneous sale in another market. 'while the arbitrage spreads measured using bid and ask prices are smaller than using only bid 'attracted by the opportunity for arbitrage with the stock market, hedge funds have also been big. The simultaneous purchase and sale of substantially identical assets in order to profit from a price. A practice of taking advantage of differences in price of the same an arbitrage trader would be in both markets in order to buy in one and sell in another for profit. In economics and finance, arbitrage refers to the simultaneous sale and purchase of identical securities or other financial instruments on different markets to take advantage of price differentials for profit. For example, gold may be traded on both new york and tokyo. The term is also used more loosely to cover a range of activities. In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: Introduction to financial economics (17ecc012). Arbitrage is the process of a simultaneous sale and purchase of currencies in two or more the arbitrage opportunities exist due to the inefficiencies of the market.

Proposed definitions will be considered for inclusion in the economictimes.com. Arbitrage is the making of a gain through trading without committing any money and without taking a risk of losing money. The term is also used more loosely to cover a range of activities. Meaning of ipo, definition of suggest a new definition. Introduction to financial economics (17ecc012).

Global labor arbitrage is where, as a result of the removal or reduction of barriers to international trade, jobs move to nations where labor and the cost. A person who does arbitrage is an. Arbitrage, business operation involving the purchase of foreign exchange, gold, financial securities, or commodities in one market and their almost simultaneous sale in another market. The standard definition of arbitrage involves buying and selling shares of stock, commodities, or currencies on multiple markets in order to profit from inevitable differences in their prices from minute. Arbitrage is the strategy of taking advantage of price differences in different markets for the same asset. Amex is a stock exchange which grew from a small set of stock market traders into the second biggest stock exchange in the usa. A practice of taking advantage of differences in price of the same an arbitrage trader would be in both markets in order to buy in one and sell in another for profit. The economics glossary defines arbitrage opportunity as the opportunity to buy an asset at a low price then immediately selling it on a different market for a higher price. Arbitrage is the process of a simultaneous sale and purchase of currencies in two or more the arbitrage opportunities exist due to the inefficiencies of the market. Arbitrage occurs when an investor can make a profit from simultaneously buying and selling a commodity in two different markets. | meaning, pronunciation, translations and examples. Introduction to financial economics notes. The term is also used more loosely to cover a range of activities.

A person who does arbitrage is an arbitrage definition. Meaning of ipo, definition of suggest a new definition.

Arbitrage Definition Economics: The standard definition of arbitrage involves buying and selling shares of stock, commodities, or currencies on multiple markets in order to profit from inevitable differences in their prices from minute.

Source: Arbitrage Definition Economics

0 comments:

Post a Comment